Claim Your Share of $576 Million in 2017

File for your share of a $576 million annual tax cut — the result of MMA’s hard-fought elimination of the Personal Property Tax (PPT) on manufacturing equipment, a primary barrier to competitiveness for many employers.

This tax cut requires manufacturers to take proactive steps and meet very specific deadlines to claim the exemption. The process includes paying a small assessment, the Essential Services Assessment, to the State to help reimburse local units for the elimination of the PPT and which must be paid by August 15.

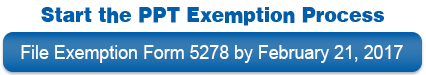

This tax cut does not occur automatically, you must act before February 21, 2017.

The PPT Savings Tool Kit — Understanding the Exemption Process

This Tool Kit provides you the information and resources to ensure your company takes the appropriate steps to receive this substantial savings. Reference the tabs along the top of the page to access different parts of the Tool Kit. Follow the instructions and it will yield substantial property tax savings for your company.