Since mid-2020, the SBA has delivered more than $1 trillion in economic aid ($173+ billion in the Great Lakes region) via COVID relief measures to help the nation’s small businesses and those hardest hit by the pandemic survive. Fiscal year-end traditional SBA-backed lending numbers should be released this week and the SBA is on schedule to celebrate National Veterans Small Business Week from Nov. 1 to 5. We also are gearing up for the 2022 National Small Business Week to return the first week of May with details on award nominations to come in November as well.

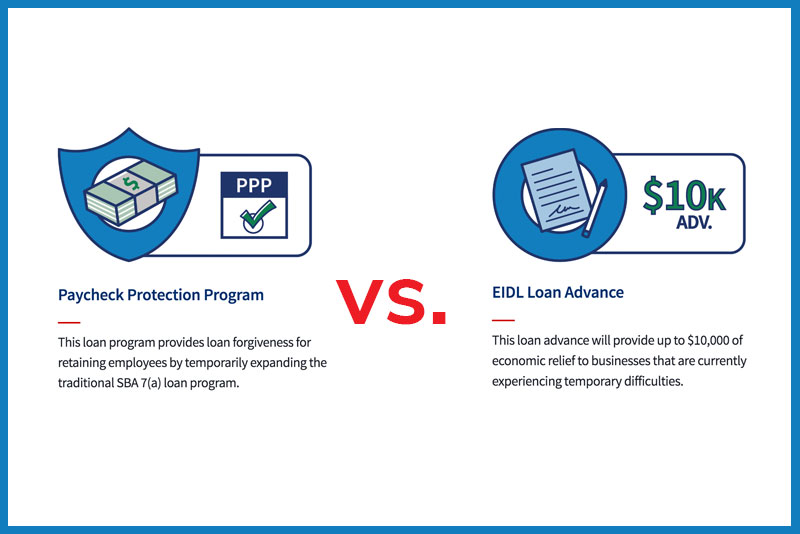

Paycheck Protection Program // direct forgiveness portal

- As of Oct. 17, PPP forgiveness applications have been received for approximately 70% of the total PPP loan volume and, for 2020 PPP loans, approximately 92% have applied for forgiveness.

- To note, on Aug. 4, the SBA opened a PPP direct forgiveness portal for those with PPP loans of $150,000 or less (news release). In less than two months, one million had used the portal to apply for forgiveness via the streamlined process (news release).

- Weekly forgiveness reports are here: PPP forgiveness platform lender submission metrics reports (sba.gov).

STILL AVAILABLE: COVID-19 Economic Injury Disaster Relief // applications remain open through Dec. 31, 2021

- As of Oct. 14, more than 3.8 million COVID EIDLs totaling $280 billion have been approved and applications remain open through Dec. 31, 2021.

- On Sept. 8, COVID EIDL program policy changes took effect (news release) and included:

- An increase of the maximum loan cap to $2 million

- Use of funds expansion to include payment and pre-payment of business non-federal debt incurred at any time (past or future) and payment of federal debt

- An extension of the deferment period to 24 months from origination for all loans

- Simplifying the affiliation requirement to an affiliate being a business the owner controls or in which an owner has 50% of more ownership

- An additional path to meet program size standards for businesses assigned a NAICS code beginning with 61, 71, 72, 213, 3121, 315, 448, 451, 481, 485, 487, 511, 512, 515, 532, or 812

- The SBA continues to disburse Targeted EIDL Advance and Supplemental Targeted Advance payments to eligible entities, with more than 445,000 receiving Targeted EIDL Advances and nearly 348,000 receiving Supplemental Targeted Advances.

- State data is available in the COVID-19 EIDL Report 2021.

Community Navigator Pilot Program: grant awards will be announced soon and range from $1 million to $5 million.

Shuttered Venue Operators Grant // portal closed to new applications on Aug. 20

- More than 12,300 initial SVOGs have been awarded totaling more than $10 billion. Per the statute, the SBA is now issuing supplemental grants to initial awardees that qualify.

- Nearly 91% of the SVOGs have gone to those who have 50 or less employees.

- Decisions on 99% of all initial applications have been issued (approximately 200 remain). The program also offered applicants the distinct opportunity to appeal an initial decision and/or request an award amount reconsideration; decisions on those are being issued as well.

- SVOG weekly data reports, including the grantee list, are here: Shuttered Venue Operators Grant (sba.gov)

Restaurant Revitalization Fund // approximately 101,000 RRF payments delivered; portal closed on May 24

- All available data re: RRF recipients can be found at:

- Restaurant Revitalization Fund Reports (sba.gov) – collective data on applications received and awarded

- Restaurant Revitalization Fund (RRF) FOIA - Dataset - U.S. Small Business Administration (SBA) | Open Data – all recipients (you can filter to identify state/local recipients)

###

About the U.S. Small Business Administration

The U.S. Small Business Administration helps power the American dream of business ownership. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.

-4.jpg)