Don’t call it a comeback…

Don’t call it a comeback…

Michigan’s economic recovery comes with some caveats

Experts are calling Michigan’s post-pandemic economic rebound among the best in the U.S., yet major challenges threaten this positive momentum.

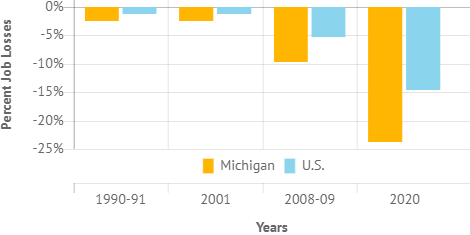

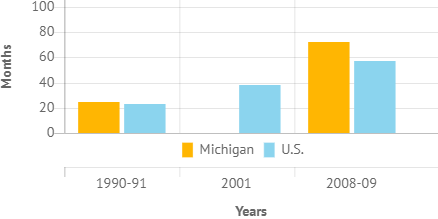

When the United States economy catches a cold, Michigan’s economy catches pneumonia. Over the last three U.S. recessions, Michigan’s economy has witnessed higher job and economic losses and has taken longer to recover than the U.S. as a whole. The COVID‐19 pandemic‐induced recession in early 2020 followed a similar pattern: job losses were much higher in Michigan than the U.S. in March and April — a 24% decline versus 15% — while the unemployment rate was one of the highest in the country at 24% in April. Overall, Michigan’s economy declined by 4.6% in 2020, compared to a 3.4 % contraction in the U.S.

While the U.S. economy recovered from the 2001 recession, Michigan never returned to prerecession job numbers.

In 2021, however, Michigan’s economy has recovered quickly. The unemployment rate — 4.6% in September – is in line with the national average, jobs are 6% below prepandemic levels and gross state product, a term that measures the overall size of Michigan’s economy, has nearly recovered to prepandemic levels. Second quarter GSP growth in 2021 was 8.3%, above the U.S. rate of 6.7%. While the relatively swift rebound is welcome news, Michigan’s economy is still working toward a full recovery. Meanwhile, according to PSC’s in‐house expert economist, Stephan Vitvitsky, four key challenges are on the horizon.

Let’s dive in:

Supply chain shortages for goods, including cars and trucks

Supported by fiscal stimulus, U.S. goods consumption has strongly rebounded. Meanwhile, U.S. services consumption, such as at entertainment venues and restaurants, has remained subdued in part over pandemic‐related fears and restrictions. This has likely induced U.S. consumers to purchase more goods. After a short period of decline in the spring of 2020, goods consumption rebounded quickly and increased by 5% over 2019 by the end of the year. In 2021, it has accelerated further; in September 2021, goods consumption was almost 10% higher than in December 2020. This dynamic in consumption patterns has benefited Michigan’s economy, which has a greater share of jobs and gross state product — 18% and 24%, respectively — tied to goods production than the U.S. as a whole, which sits at 14% and 17% in those same areas.

At the same time, shortages have emerged for certain goods, such as light vehicles — typically described as cars, pick‐up trucks and SUVs. U.S. inventories of light vehicles have hit historic lows since the pandemic began, declining by over 85% since February 2020, largely due to major delays or shortages in critical supply inputs, such as semiconductors, as well as strong demand. Given the importance of goods to Michigan’s economy, particularly light vehicles, a sustained economic recovery largely depends on the timing and pace of resolving supply chain disruptions. Once supply chain conditions improve, the rebuilding of inventories will likely provide a meaningful contribution to economic growth in Michigan, even if overall goods consumption declines.

Low labor force participation and high job openings

Along with the rest of the nation, Michigan’s labor force participation rate — the sum of employed workers and unemployed people looking for jobs as a share of the working age civilian, noninstitutional population — declined during the pandemic from 61.6% in February 2020 to a low of 57.4%. In other words, many workers have exited the labor force, particularly women, in part due to a lack of reliable child care and schools closing.

Michigan’s participation rate has been below the U.S. average since the early 2000s and had sharply dropped below the U.S. rate after the 2008 – 2009 recession. While the exit of women from the labor force has been a significant element in the recent fall in the participation rate, skills and education deficits, health issues and an aging population are also drivers. Amid the economic recovery, the labor participation rate will be a key factor to watch. If Michigan’s labor force increases, the unemployment rate may also increase — provided most new people entering the labor force do not quickly find jobs — but this would still be a positive development that reflects greater confidence in job prospects, child care availability and schools remaining open for in‐person instruction.

Given that Michigan’s job opening rate — 7.2 in August — the number of job openings divided by total filled and unfilled jobs — has been at record levels this summer and higher than in the U.S. rate of 6.7, a meaningful portion of people who choose to reenter the labor force should find jobs. Moreover, with relatively low labor participation and relatively high job openings, the mismatch between labor supply and demand appears particularly high in Michigan. The wide mismatch is one factor why average private hourly wage growth in Michigan for 2021 through September, at 4.1%, has been strong and higher than private U.S. wage growth of 3.1%, with employers raising wages to fill job openings. Still, rising inflation has largely offset those gains.

Equity

The estimated unemployment rate for Black Michiganders was 8.2% in the first quarter of 2021, down considerably from 35.5% in the second quarter of 2020. Of the states with available data, the unemployment rate for Black Michiganders was among the highest in the country during the peak of COVID‐19 but has since fallen to among the lowest. At the same time, it is double the unemployment rate of white Michiganders — 4.6% — as of the first quarter of 2021. While the decline is welcome and has likely continued to drop amid the broader fall in Michigan’s unemployment rate, the gap is still too wide. Moreover, a recent survey from the University of Michigan suggests that the unemployment rate in Detroit in July 2021 was as high as 25%, much higher than official unemployment statistics.

Regional disparities following the 2020 census

The 2020 census, combined with job figures, revealed that three distinct regions in Michigan had emerged:

- 31 counties with population increases from 2010 to 2020 and job increases from 2010 to 2019, including some that outperformed the state increases of 2% and 15%. 2020 was excluded from the jobs time frame since nearly all counties lost jobs during the first year of the pandemic.

- 17 counties with population declines and job declines

- 33 counties with population declines and job increases

If the prepandemic trends continue, they point to significant population and economic disparities in Michigan.

People and jobs appear to be increasingly concentrated in a corridor from southwestern to southeastern Michigan, with lower prospects in the rest of the state, excepting several counties along or near Lake Michigan. Meanwhile, most counties in the Upper Peninsula and several in northern Lower Michigan witnessed population and job losses. Finally, many counties in central Michigan, along Lake Huron and on the borders with Indiana and Ohio witnessed population losses but job increases. The divergence is consistent with a recovering economy following the 2008 – 2009 recession, as many Michiganders found jobs in their communities despite those communities losing people over time. Still, some of these counties witnessed lower job increases than the Michigan average of 15%, calling their economic development prospects into question. Only two counties had population increases but job declines.

These trends will likely continue, which will have significant implications for mobility, infrastructure, housing, education, energy services and tax bases, within and between high‐ and low‐growth areas. Counties that witnessed negative population and job growth will face particularly difficult challenges.