as Labor Market Recovery Is Heating Up

as Labor Market Recovery Is Heating Up

- Initial claims for unemployment insurance fell again the week ending April 17, and were at their lowest level since before the pandemic.

- Other measures of unemployment insurance were mixed in the first half of April, but have generally improved in the spring.

- The labor market recovery is gaining traction due to vaccines, stimulus, and better weather.

Initial claims for unemployment insurance under regular state programs fell to 547,000 in the week ending April 17, down from 586,000 the previous week (revised up by 10,000). The four-week moving average of claims fell to 651,000 in the week ending April 17, down by almost 28,000 from the previous week. The consensus expectation was for a small increase in claims, to 625,000.

After being stuck between 700,000 and 900,000 per week for most of August 2020 to March 2021, initial claims for unemployment insurance have dropped sharply. They are now at their lowest level since mid-March 2020, just before the pandemic disrupted the U.S. economy. And claims below 600,000 for two straight weeks indicate that this improvement is not just a one-time blip. Claims skyrocketed from around 225,000 per week in early 2020 to a peak of more than 6 million in April 2020. They then fell steadily over the next few months, before plateauing in August through March.

Initial claims under the special Pandemic Unemployment Assistance program rose slightly in the week ending April 17, to 133,000, from 132,000 the prior week (not seasonally adjusted). Despite the small increase, initial PUA claims in the past two weeks have been at their lowest levels since the program started in April 2020.

There were a total of 17.405 million people receiving some sort of unemployment benefit, including pandemic-related benefits, in the week ending April 3, up from 16.913 million in the previous week (not seasonally adjusted). Still, outside of the beginning of 2021, when pandemic-related programs briefly expired, these have been the lowest two weeks of total beneficiaries since before the pandemic. Total beneficiaries peaked at more than 32 million in June 2020. However, before the pandemic, about 2 million people were receiving some form of unemployment insurance.

The number of people receiving UI benefits under regular state programs fell to 3.674 million in the week ending April 17, down from 3.708 million people the previous week. This number has steadily declined since peaking at 23 million in May 2020. Some of the improvement has come from beneficiaries finding work, but some has also come from beneficiaries using up their eligibility and moving to pandemic-related programs. Before the pandemic about 1.7 million people were receiving regular state benefits a week.

The big drop in initial unemployment insurance claims over the past two weeks is signaling the long-awaited labor market recovery. Even as job growth has picked up over the past couple of months, according to the monthly employment numbers from the Bureau of Labor Statistics, initial claims for unemployment insurance have remained stubbornly high. But they are now down to their lowest levels in more than one year, before the pandemic. Still, unemployment remains far above its pre-pandemic level.

Job growth in the spring of 2021 is receiving a boost as better weather allows for more outdoor activity. And job growth will remain very strong throughout 2021 and into 2022 thanks to vaccination efforts and stimulus payments that are supporting consumer spending. PNC expects the unemployment rate, which was at 6% in March, to fall to around 5% at the end of this year and around 4% at the end of 2022. The unemployment rate was around 3.5% before the pandemic in early 2020, and then soared to a peak of 14.8% in April of last year, the highest rate since the Great Depression.

The PNC Financial Services Group, Inc. is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

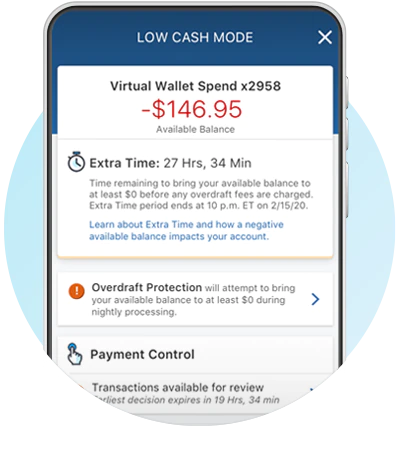

the slide show below includes PNC Low Cash Mode Infographic

-1.png)