LAFCU’s personal finance course grads ‘better prepared for life success’

Michigan credit union’s comprehensive course helped students improve credit scores,

start savings accounts, pay off debt, create budgets

LANSING, Mich. — The seven adults who completed LAFCU’s first comprehensive personal finance course have already reaped benefits of the 16-session course designed to help participants improve financial behavior and build a roadmap to attain financial freedom.

The graduates of LAFCU Pathway to Financial Transformation are Barbara Andersen, East Lansing; Michael Boles Sr., Lansing; Mackenzie Callahan, Normal, Illinois; Cathy Daniels, Dimondale; Robin Kinzel, Howell; Tabitha Thompson, St. Johns; and Lori Wurm, St. Johns.

“By understanding that financial wellness is the underpinning of a good life, these community members are now better prepared for life success,” said Shelia Scott, community financial education & business development officer who led the course. “Students were at various stages of their lives: Some wanted a complete reset of their financial situation; others wanted to purchase a large asset, such as a house; and some wanted to learn more about investing or how to make assets work best in retirement.

“It was especially rewarding to see that by the end of the course some graduates had already improved their credit score, stopped living paycheck-to-paycheck, started a savings account, and paid off debt.”

Cathy Daniels summed up the course’s impact on her: “It changed my life. It is so useful to everyday life, it should be required learning for everyone.”

Lori Wurm knew that she and her daughter, Robin Kinzel, were at stages of their lives in which they could both benefit from intensive financial education: Wurm was starting a new career as owner of Woodbury’s Flower Shop in St. Johns, and Robin was engaged to be married.

"The course was more like a conversation than a lecture class,” Wurm said. “Often you feel alone about finances, but Shelia made it seem so easy. The information was insightful, and the experience boosted our confidence that financial freedom is within our reach. We now know that when we have a plan for success our chances of achieving it are so much greater.”

At a cap-and-gown ceremony for the graduates, LAFCU CEO Patrick Spyke said, "We might not be changing the financial wellness of 100,000 lives today, but we've started the journey. We will continue on that path because we know a little education can make a big difference for so many in our community.”

He then challenged the graduates: “If each of you share some of what you learned in the program with a friend or relative, you can double this program’s impact. If they each share it with another person, the reach spreads exponentially.”

Classes were spread over eight months so students could see benefits of making even small changes in their financial behavior throughout the course. It was free and structured similarly to a college course with a syllabus, assignments, and quizzes.

Topics included all facets of personal finance that support an individual’s pursuit of financial freedom, including traps that can derail a person’s financial stability. Guest speakers were LAFCU financial professionals with one session led by a representative of LAFCU’s financial counseling partner, GreenPath Financial Wellness, Farmington Hills.

LAFCU plans to continue offering the course to help others improve their financial future. The next session begins fall 2022. For more information, contact Shelia Scott at SScott@lafcu.com. Participation is free and open to the public. It is not necessary to be a LAFCU member.

The Pathway to Financial Transformation personal finance course is the most recent compliment to LAFCU’s financial literacy program, which includes free classes for adults on singular financial topics and real-world financial education opportunities to K-12 students.

About LAFCU

Chartered in 1936, LAFCU is a not-for-profit financial cooperative open for membership to anyone who lives, works, worships or attends school in Michigan and to businesses and other entities located in Michigan. The credit union serves 72,000 members and holds over $970 million in assets. It was named a Best Credit Union to Work For in 2020. LAFCU offers a comprehensive range of financial products and services as well as an expanding complement of financial technology solutions. Members enjoy benefits such as low fees, low interest rates on loans, high yields on savings, discounts, knowledgeable employees and nationwide access to fee-free ATMs. A recipient of the national Dora Maxwell Social Responsibility Community Service Award for credit unions, LAFCU enriches the communities it serves by supporting many organizations and causes. To learn more about LAFCU, call 800.748.0228 or visit www.lafcu.com.

# # #

Photo captions

LAFCU graduation1.jpg — Four of the graduates of LAFCU’s first Pathway to Financial Transformation Program are, from left in caps and gowns, Lori Wurm, Michael Boles Sr., Robin Kinzel and Tabitha Thompson. LAFCU representatives pictured are, from left, Shelia Scott, Kelli Ellsworth Etchison and Patrick Spyke.

LAFCU graduation2.jpg — Graduation is a family affair for educator Tabitha Thompson, right, shown with her children and mother, Jennifer Humble, who encouraged her daughter to pursue the program by offering to babysit.

LAFCU graduation3.jpg — Mother-daughter Lori Wurm, at left, and Robin Kinzel, second from right, tackled the personal finance course together. They are with their husbands, from left, Cal Wurm and Jake Law.

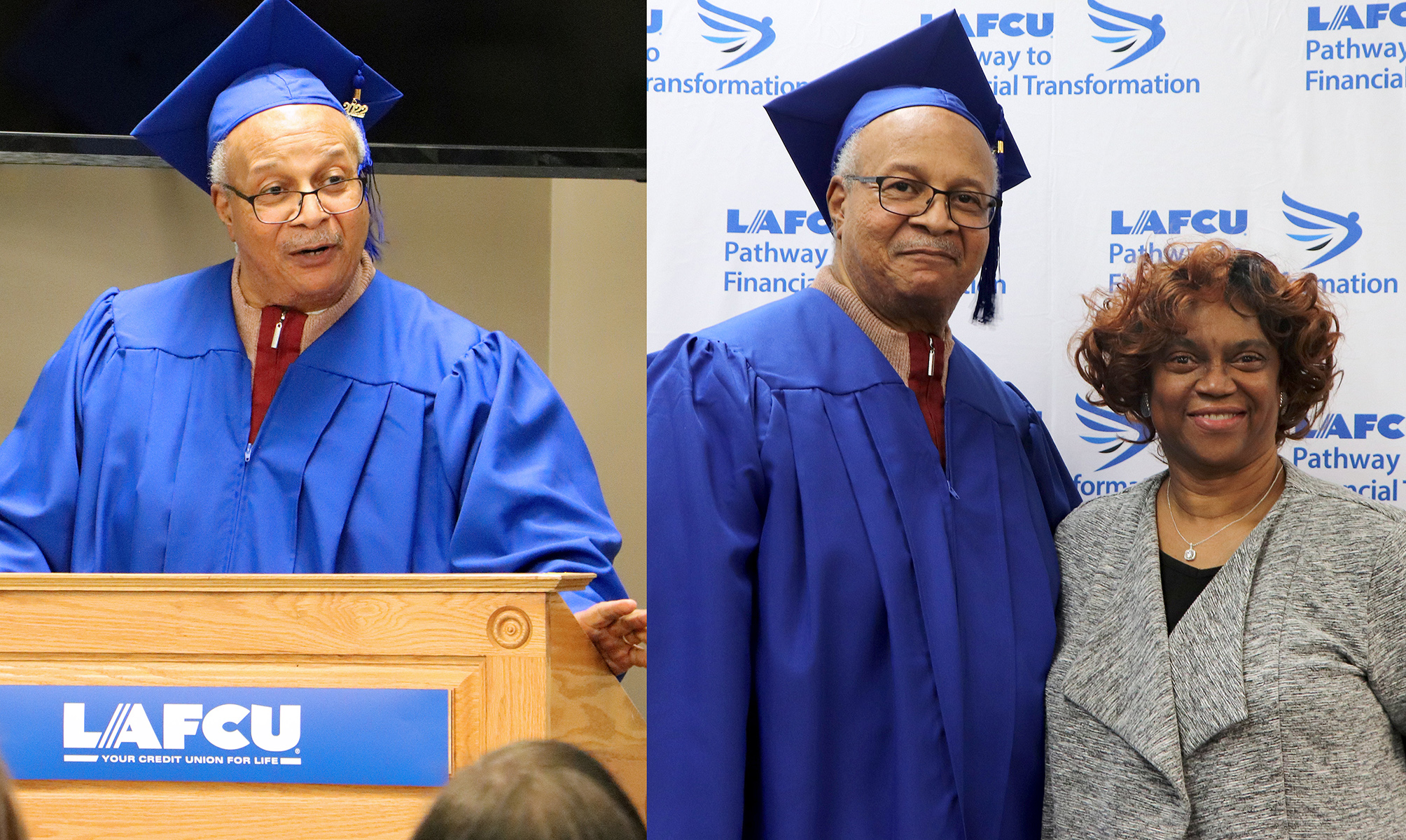

LAFCU graduation4.jpg — Graduate and retired educator Michael Boles Sr. uses his time at the lectern to praise the course and urge LAFCU to continue to help schools provide financial education curriculum for students. He’s also shown with his wife, Flora