Cherry Republic Cultivates New Growth Opportunities

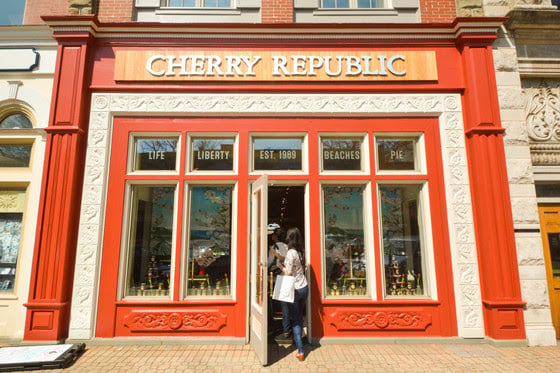

The Traverse City area is known across the country as the nation's "Cherry Capital," so it is only fitting that Cherry Republic calls the region home. Since 1989, the company has leaned into the community’s lighthearted moniker, building its success by selling more than 200 cherry-based products, ranging from nut mixes and salsas to cherry-infused wine and beer.

When Cherry Republic decided to take on a new challenge and set out to increase its footprint in Michigan in 2018, it knew from experience that it could turn to the MEDC for the support it needed. The company was already familiar with the MEDC’s range of business services by then; in 2016 and 2017, the company benefitted from the International Trade team’s State Trade Expansion Program grant to help it expand its products to the Asian market, participating in trade shows and sales trips to China and Taiwan.

But business expansion does come with challenges. Cherry Republic was experiencing rapid growth, and as a result it needed assistance in accessing the additional capital needed to to establish a presence in new Michigan communities. That is where the MEDC’s Capital Access program came in.

Focused on providing businesses access to the resources needed to grow, the MEDC’s Capital Access program helps reduce financial risks for lenders by working with financial institutions to offer support through mechanisms like collateral shortfall and microlending loans.

“At Cherry Republic, we care deeply about the quality of not only our products, but the customer’s experience when visiting our stores. We knew we wanted to build quality retail spaces for our products, and that meant spending more than a typical brick-and-mortar store would to get our products into these additional communities,” said Todd Ciolek, CEO of Cherry Republic. “After experiencing such significant growth in our business over a short period of time, it was difficult to balance our ambition for growing in Michigan while at the same time ensuring we made wise financial decisions. Having the additional support from the MEDC to increase buy-in from the bank really made all the difference for our company.”

“At Cherry Republic, we care deeply about the quality of not only our products, but the customer’s experience when visiting our stores. We knew we wanted to build quality retail spaces for our products, and that meant spending more than a typical brick-and-mortar store would to get our products into these additional communities,” said Todd Ciolek, CEO of Cherry Republic. “After experiencing such significant growth in our business over a short period of time, it was difficult to balance our ambition for growing in Michigan while at the same time ensuring we made wise financial decisions. Having the additional support from the MEDC to increase buy-in from the bank really made all the difference for our company.”

Today, Cherry Republic is no longer considered a "regional" business. With support from the MEDC, the company was able to open and renovate three new storefronts in Holland, Frankenmuth and Ann Arbor, creating 12 new jobs and increasing overall sales while laying the foundation for future growth.

“We had already known for years about the great work done by folks at the MEDC. I believe that their hands-on support and guidance enabled us to reach our current level of success much faster than if we had been working on our own," said Ciolek.

“Cherry Republic is clearly a very successful company that matured and grew at a rapid rate, and because it had access to this program through the MEDC, the bank was provided additional tools to better assist in their growth within the state,” said Jason Blain, Vice President of Commercial Loans at Independent Bank, the financial institution that worked with the MEDC and Cherry Republic to support the company’s expansion.

and because it had access to this program through the MEDC, the bank was provided additional tools to better assist in their growth within the state,” said Jason Blain, Vice President of Commercial Loans at Independent Bank, the financial institution that worked with the MEDC and Cherry Republic to support the company’s expansion.

While Cherry Republic continues to explore growth opportunities throughout the state, it has remained true to its roots as a local, northern Michigan company. No matter what comes next for Cherry Republic, one thing is for certain: it knows the MEDC is available to support its continued success in Michigan.

To learn more about the tools and services the MEDC can provide, go tomichiganbusiness.org.

Capital Access Programs Available to Lenders: MEDC Capital Access has a variety of resources available to reduce risk for lenders so they can provide customers with financing that otherwise could not be offered. These programs bridge the gaps that exist in commercial lending for collateral shortfalls, speculative cash flows and lending limits.

Collateral Support Program: This program provides cash collateral accounts to lending institutions to enhance the collateral coverage of borrowers. This program seeks to enable borrowers to acquire the necessary financing that may otherwise be unavailable due to a collateral shortfall.

Loan Participation Program: The MEDC can participate with a lender for new financing that decreases the lender’s credit exposure. For projects with speculative cash flows, the MEDC may offer a grace period on repayments.

For Loan Participation and Collateral Support information, contact Aileen Cohen atcohena@michigan.org.

Capital Access Program: This program is available to assist businesses with capital needs. Similar to a loan loss reserve fund, the bank, the company and the MSF pay a small premium into a reserve that makes it possible for the company to receive fixed asset and working capital financing.

For Capital Access program information, contact Amber Marlatt atmarlatta2@michigan.org or visit www.michiganbusiness.org/services/access-capital/.

|

|